What Are Index Funds And How To Use Them

As an Amazon Associate I earn from qualifying purchases. We may earn money or products from other companies mentioned in this post at no cost to you!

Reading Time: 4 minutesIf you’ve ever even noticed any writing on finance topics, you’ve probably seen the term “index funds” somewhere. But what exactly are index funds, and why do they seem to get a lot of attention?

Here’s some quick info about what they are and why you should consider them, whether you’re a beginner investor or advanced.

Please keep in mind that any funds mentioned here may or may not be owned by me, or I may have owned them in the past. I’m not suggesting you invest in these particular funds, they are simply for purposes of example because they are popular, they were mentioned in an article I’m citing, and fit the criteria of the example I’m trying to make. See my disclosure policy for more.

What’s An Index?

Index funds follow an index. So let’s start with what an “index” means.

If you ever see market news, you usually see the performance of three major markets, or indices: the Dow Jones Industrial Average, the Nasdaq, and the S&P 500. These indices are made up of different companies, and the daily price movement of the stock of those companies determine the performance of that market for the day.

For example, the S&P 500, in simple terms, is made up of the 500 largest companies in the U.S, such as Apple, Amazon, Microsoft, etc. Therefore, an index fund, which is supposed to mirror the composition of this index, will also mirror its performance. If the S&P 500 goes up 2% in one day, whatever S&P 500 fund that you’ve invested in should have the same, or nearly the same, increase.

SPY, for instance, is a well known S&P 500 index ETF. If you compare its performance to the market, you’ll see there’s virtually no difference.

And there’s a mutual fund or ETF that follows almost any index you can think of! There’s indices for bonds, international firms, large value stocks, large growth stocks, commodities, etc. If you already have a brokerage or retirement account somewhere, use your research tool to explore these.

If you don’t have an investment account outside of your employment, I highly recommend M1 Finance. They make investing for beginners and novices so easy, and provide great graphics to fully understand how your money is invested. The research tools are also easy to use to compare and contrast different funds. They usually have a sign up bonus, as well! Check them out here.

Why Are Index Funds Popular?

Index funds generally have very low fees compared to other fund types, and they’re getting lower.

They can charge lower fees because index funds are passively managed. This is converse of an actively managed fund, which has a manager who is picking stocks to add to its fund. The passively managed funds ensure that the allocation of the stocks within the fund mirror the market’s allocation. There is no more thought into it than that. Because there is less need for research and trading stocks in and out of the fund, there aren’t as much expenses to cover.

Another reason for their popularity is that choosing an index fund requires a lot less decision-making, and a lot less stress. While you may not be picking individual stocks, trying to pick the best mutual fund or ETF amongst thousands could still be a lot of work with little reward in the long run. And, let’s be honest, there are so many factors involved that we lay people probably aren’t the best to be picking funds, anyway.

Index Funds vs. The Others

Isn’t the goal to beat the market, not just meet its performance?

Well, yes, that would be nice. However, after studying the actively managed funds vs. passively manage funds (like index funds) for 15 years, we now know that 92% of active fund managers are underperforming the market!

And, by the way, they probably are charging at least 2% or more on that underperformance.

In this article, it provides an example of Warren Buffet, who has a proven track record of profitable stock picking, providing a return of 9.4% vs. 9.1% if someone had invested in VTSAX, the Vanguard Total Stock Market index fund. Once you factor in the fees Warren Buffet charges vs. an index fund, you’d be better off being invested with the index fund than with one of the best investors in the world!

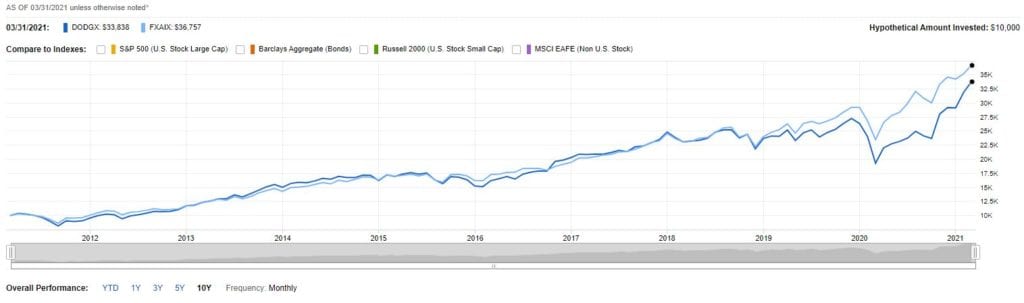

As an example, I’ve compared DODGX, a large cap actively managed mutual fund. This fund has been around since 1965, so it has a long track record! Its longest tenured fund manager has been there since 2002. This was one of the first investments I ever had because it was an investment option in my 401K. You’d think that the experience of the managers and the longevity of this fund would make this a for sure winner.

However, we’re talking about index funds here so I compared this to a S&P 500 index fund, FXAIX. This is also a large cap fund, but one that is passively managed and mirrors the composition of the S&P 500 market. You can see that the index fund actually comes out ahead over a 10 year period!

I didn’t include the S&P 500 performance because FXAIX follows the performance exactly and you wouldn’t be able to see the comparison line.

Yes, actively managed funds can beat the market sometimes. You can see that DODGX slightly beat the market in a couple of instances. You’ll notice that they can also beat the market in bad ways, like when there’s a down year and those funds do worse than the market itself. And you know that they’ll still charge their fees.

Closing Thoughts

Index funds are simple, easy, low-cost, and low maintenance (check out this post for some more index fund suggestions, and this post from Frugal Expat about starting your own simplified index portfolio). They are typically provided even in your employer-sponsored retirement accounts. With your M1 Finance account, you can easily find these and add them to your investments.

If you’re planning on directing your own investment dollars, I suggest this simple strategy to keep your money growing for you!

RELATED

See this article for a beginner’s guide to investing within your 401K

See this article about dividend stocks, which you can also find an index fund for

IF YOU WANT TO SEE MORE…

Consider subscribing to my e-mail list. You can always unsubscribe, I won’t spam you!

Follow me on Facebook, Instagram, or Twitter.

Save this post on Pinterest by using the share buttons, and follow me, too!

If you want to start a blogging business, check out this FREE course!

If you want to make money from a blog, check out this program that got me started making my own money blogging!

8 Comments

FreshLifeAdvice

It’s amazing how much overwhelming evidence there is that passive index funds consistenly outperform the actively managed funds. Yet somehow, humans are still so greedy that they have the blind optimism to believe that the actively managed fund they choose will be in the 8% that outperform the market. Human psychology is so interesting!

Ashley

And I’m guilty of that belief! I think partly because my investing journey really started around 2010, and growth stocks have been the performers during this time period. But, I am looking ahead and changing that strategy but because, yes, if you’re looking at a longer time horizon, the passive funds outperform. 🙂

Dan - Bearmoney

The fees are always killers, I just can’t wrap my head around people paying a premium for stock picks that net don’t perform the index. We need to hammer home to Index/ETF message!

Ashley

Yes!!! Times have changed. Thank goodness for index funds!

Cristian @ Financial Alien

Index Funds are indeed the simplest form of investing. They are truly set it and forget.

The problem lies that we need compound interest and time to see what Index Funds can do for us. And that’s where most people fail.

We live in a world of instant gratification, and most people don’t want to wait 5, 10, 20 years to see compound interest do its magic.

They want to invest today and see a return tomorrow, which is not investing but instead gambling. A few win, the grand majority lose.

Steve @ The Frugal Expat

I personally love index funds. It is a great way to have passive income. You invest the money for the long term and the funds will match the market. There will always be up and down years, but in the long run index funds will win. The S&P 500 has averaged around 10% in the last 100 years. It is hard to beat that.

I really enjoyed the comparison with a long-term actively managed mutual fund DODGX.

Great article Ashley!

zortilonrel

This web site is really a walk-through for all of the info you wanted about this and didn’t know who to ask. Glimpse here, and you’ll definitely discover it.

how much money do youtubers make

My brother recommended I might like this blog. He was entirely right. This post truly made my day. You cann’t imagine simply how much time I had spent for this information! Thanks!